Debt is the master and you its slave. Perhaps that is an oversimplification, but most types of debt can quickly gain a stranglehold on the hapless consumer. I’ve somehow managed to avoid debt so far, so I don’t have the same level of empathy as someone who has successfully bounced ‘back from the debt’ (tongue in cheek). However, I have watched others make the journey from debt to surplus savings successfully, so I have an idea of what works and what doesn’t. Also, the same principals that apply to debt deliverance are how I’ve successfully saved for the major expenses I’ve faced in life. With that little bit of introduction and caveat regarding my non-experience with debt, here are 10 creative ways to learn how to get out of debt, and stay out.

How to Get Out of Debt

1. Shred Those Credit Cards

One of the most vicious kinds of debt is consumer credit card debt. Credit cards are a useful way to build credit, but if you have a history of not being able to pay off your credit cards every month, just get rid of them completely. The interest rates on credit cards are off the charts and definitely not worth paying. Make paying off your cards the first priority on your journey to a debt free life.

2. Read or Listen to Books on Personal Finance

2. Read or Listen to Books on Personal Finance

Whatever you focus on in life becomes part of who you are. Reading books on personal finance and debt elimination will help you achieve your financial goals. But be careful, not all books offer the best advice. Here are a few I would personally recommend:

- Your Money or Your Life – A classic book that really gets down to the whole reason you should stay out of debt in the first place, live within your means and spend your life doing something other than working like a slave to stay out of bankruptcy.

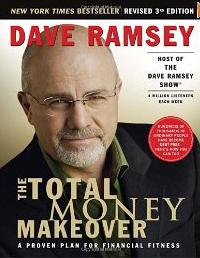

- Total Money Makeover – Excellent book by personal finance guru Dave Ramsey. There are excellent financial tools and ideas in this book that you’ll refer to again and again throughout your life.

- Financial Peace University CD Set – Commuting to your second job as you pay down that debt load, leaving no time to read? No problem. Get this excellent CD set for less than the price of a tank of gas and you’ll find Financial Peace in no time. Here’s a frugal tip: get it used for half the cost of new and put the money you saved towards paying off your debt

3. Live Frugally

This one is a given and pretty simple once you get the hang of it. Look at every expense and find a way to dial it down. Start with the big ones first. High rent? Downsize. You’d be surprised how easily you can fit in an 800 square foot house once you get rid of everything that you don’t need. Making payments on a car? Sell it and get a 10 year old Honda Civic or Toyota Corolla. Paying for cable? Drop it completely. Cable television seems to have more ads than content these days anyway, making you want to spend your hard earned money on stuff you don’t need. That’s just a start. Make it as unique as your situation in life. Live simply and start saving.

4. Make Extra Money

Think about how you can add to your bottom line. Whether its negotiating a raise at your current job, working a second job or starting a part time side gig, find a way to make some extra cash to put directly towards paying off your debt. Read the article I wrote recently, 10 Creative Ways to Make Money to get some ideas.

5. Just Say ‘No’ to Borrowing

Many people get started in the debt trap by borrowing money for common big ticket items like a refrigerator or new couch. Marketers have some pretty enticing deals to snare people with. Just think, you could have a new living room furniture set with zero down and no interest for 12 months! But eventually, you’ll have to pay and by then you might be in even tighter financial circumstances than today. Another thing, if you pay cash for any big ticket item, the price is ALWAYS negotiable, meaning you’ll save a bundle if you pay up front.

6. Create a Balance Sheet

Every business has what is called a ‘profit and loss’ statement or P & L. Like every smart business, each month, take inventory of what came in and what went out. Armed with this information, you’ll be able to create a budget that you can reasonably stick to and find out any areas of ‘waste’ that you can eliminate. Over time, those negative numbers will turn to positive numbers. Going from red to black will bring a sense of incredible freedom to you.

7. Graph Your Net Worth

Using a free tool like Mint.com, you can aggregate all your financial account information in one place and see a graph over time of your net worth. This will be an encouragement in the daily grind of hard work and sacrifice it will take to climb out of the debt hole.

8. Pick Frugal Friends

If you find yourself in a social circle that parties hard every weekend or enjoys going out for expensive dinners together, you might need some new friends. Find friends that will encourage you in your race to debt free living and whose financial habits more closely mirror your own. This will help you avoid the social pressure of ‘keeping up with the Jones-es’ so to speak.

9. Stay Focused and Enjoy Simple Rewards

If you’ve been accruing consumer debt for several years, face the fact that you probably won’t be out of debt in three months. Get focused on the long haul, and reward yourself (in frugal or non-monetary ways if possible) for each milestone along the way. Example: for every $1,000 you pay off on your credit card debt, reward yourself with a relaxing picnic in the park or a refreshing home-made fruit smoothie as you read a chapter from one of the books mentioned in #2.

10. Once You Achieve Your Debt Free Goal, Start Saving

Saving for a rainy day used to be a common practice for most people. The credit card ‘eliminated’ that practice, but its good to get back into the habit. Set aside 3-6 months worth of income in an ’emergency fund’ that you can use to pay for life’s unexpected expenses.

For the readers: have you successfully gone from debt to surplus? What other ways can someone who is in debt climb out and experience the joy of debt-free living?