America has a love affair with cars that dates back to the early Model T automobiles kicking up clouds of dust on the unpaved roads of the time. Henry Ford created a mass-production system that brought the cost of car ownership to an affordable level for the majority of Americans. This made car ownership not only possible, but necessary as our ever widening ‘suburbs’ made other forms of transportation obsolete. Soon after, car ownership became a status symbol and for every self-respecting young man, buying a car or being given a car shortly after learning to drive became a right of passage. What most Americans don’t realize, is car ownership can keep you from achieving your financial goals and living a financially responsible lifestyle. We’ll explore this idea further in the article below.

What is the Cost of Car Ownership Today?

Cars are a fantastic invention. We went from driving a 15MPH horse-and-buggy on virtually all unpaved roads, to being able to zip around virtually anywhere in our cars at speeds of up to 80MPH! But, this new found speed and autonomy came at a price. Let’s take a moment to look at the true cost of car ownership.

Initial Cost & Depreciation

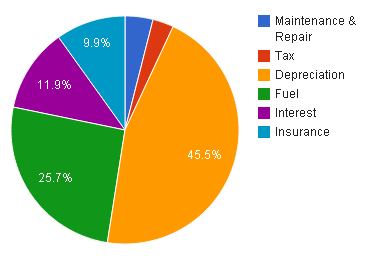

Consumer Reports used data from over 300 vehicle owners to come up with the data for the pie chart on the right. The average purchase price for a new car in the US this year is $30,000. Most people don’t have $30,000 dollars to plunk down on a new automobile, so they finance it. Financing an item that depreciates several thousand dollars as soon as you drive it off the lot seems like a bad financial decision to me. If you look at the chart, you’ll see that the combined costs of vehicle financing and depreciation is over 50% of the total cost of car ownership!

Consumer Reports used data from over 300 vehicle owners to come up with the data for the pie chart on the right. The average purchase price for a new car in the US this year is $30,000. Most people don’t have $30,000 dollars to plunk down on a new automobile, so they finance it. Financing an item that depreciates several thousand dollars as soon as you drive it off the lot seems like a bad financial decision to me. If you look at the chart, you’ll see that the combined costs of vehicle financing and depreciation is over 50% of the total cost of car ownership!

The Long-term Cost of Car Ownership

Cars require maintenance. Depending on the make and model you choose, they can require a LOT of maintenance. But, when compared to the other costs of car ownership, maintenance slides in at a very low 4% of the total. So, where is your money going? After depreciation, fuel is the largest expense. The cost of fuel rises steadily each year, causing us to look for alternative fuels such as diesel or propane or even left over grease from McDonalds. Of course, there are ways we can reduce our fuel consumption. But it remains as one of the main costs of vehicle ownership.

How I Beat the Average Cost of Car Ownership

I’ve owned four vehicles in my eleven-year driving career. The first three were basically rust buckets that got me from point A to point B. After the last vehicle blew a head gasket, I realized that it just didn’t make financial sense to pay less than $2,000 for a vehicle. Below that price point, they generally don’t last very long without needing major repairs.

I Paid Cash

In January of 2007, I ponied up the ‘massive’ sum of $4,000 and bought a 1995 Honda Accord with 232,000 miles on it. There was no financing involved. I paid cash. As far as depreciation goes, how much can a $4,000 car depreciate? Anything that runs, commands a price over $1,000 these days.

My Cost of Ownership Per Mile

J.D. Roth from Get Rich Slowly wrote an article a few years back, calculating his per mile cost of ownership, which inspired me to figure out what mine is.

Based on the purchase price of my vehicle spread out over five years ($4,000), the interest paid ($0), and the annual average miles driven (14,600), I calculated that for the past year my average cost per mile is less than 6 cents. But that’s only for the car itself. Once you add operating expenses we find that fuel is my biggest vehicle expense:

- Fuel: $1,900 ($0.13 per mile)

- Insurance: $520 ($0.04 per mile)

- Service: $550 ($0.04 per mile)

So my total average cost of car ownership is a only 27 cents per mile contrasted with the national average of 56 cents a mile (medium sedan/15,000 miles annually).

From an annual budget perspective, my total cost of car ownership is a mere $3,620 per year. Compare this number with the national average of $8,946 and it’s easy to see the savings. And, its not hard to do.

How to Reduce Your Total Cost of Car Ownership:

- Check ratings on carsurvey.org and consumerreports.org

- Always Buy Used

- Pay Cash (as a rule of thumb your house is the only thing you should finance).

- Be careful on Craigslist. Your best bet is to have a used car salesman as a friend who can find you the best deal and won’t rip you off.

- Reduce your dependance on a car (bike, live close to amenities, telecommute for work).

What are ways you’ve saved on the cost of car ownership? Feel free to comment below.