This is a guest post from Jessica Chase who writes for Organic Baby Nook website , the premium guide to organic baby products for earth-conscious parents. Organic Baby Nook features only certified-organic baby products from companies that are consistent with this philosophy.

For the longest time excess was the name of the game, but now people are thinking more about the environment, and they are considering what their choices and decisions do to the planet. This has caused many parents to instill life lessons in their children about living simply. Doing this can be a little difficult, and it only gets harder when children learn about peers that are still living in excess. Here are several things you can do to teach your child the importance of living a simpler life from a very young age.

Toy Selection

Kids love light up, foam dart equipped, robotic and not very imaginative toys. These toys do most of the work for the child, and this causes him or her to drop it rather quickly. They also teach to live in excess due to the amount of parts and resources they use.

Kids love light up, foam dart equipped, robotic and not very imaginative toys. These toys do most of the work for the child, and this causes him or her to drop it rather quickly. They also teach to live in excess due to the amount of parts and resources they use.

It’s better to buy fewer toys. You should encourage your child to go outside and play, or to use his or her imagination. A few simple and traditional toys also work well. For example, building blocks and puzzles. This encourages your child to use one toy for many uses, and to get hours of fun out of it while using his or her imagination to build things.

This will teach children that they don’t need a lot of toys, and it will encourage them to do things on their own.

Good Shopping Habits

Children commonly absorb and mimic their parents in almost every aspect. One way to use this to your advantage is to show them good shopping habits. For example, if you want a new red dress, but you already have a similar one, then tell your child that you are not going to buy it because you have a similar dress at home.

Children may not completely understand this at first, but the pattern will generally carry over to when they are adults.

Encourage Purging

Children are typically encouraged to hoard. Parents tell them to hold onto toys and other items, and they learn that keeping everything is a good idea. While it is good to keep things that are necessary, your children should also learn that it is acceptable to get rid of items that you no longer need.

You should encourage your child to go through his or her toys and clothes every six months to find things that are no longer fun, necessary or needed. The items can then go to charity.

Teach Money Management

This is a way to teach your child about the value of hard work, and how to manage and make money. Give your child a list of common chores. Then tell your child that any extra chore he or she does will get them a small amount of money, or credit towards a new toy or clothing.

This will teach children that they need to work to get things, and they will also appreciate the things that they get from working. These children often want less because they are happier with the things they receive.

Have an Uncluttered House

Having clutter around the house teaches your child that it is acceptable to have a lot of things that you really don’t need. It also teaches them to hold onto items for long periods of time. It is better to have a simple house with fewer items. This encourages your child to hold onto fewer items, and they will learn that it is OK to live without hoarding.

Sponsor a Poor Child

Telling children that there are those out there that don’t have much money or things is difficult for children to understand. Sponsoring a child puts a face on poverty, and your child will learn the difference between living simply and being in poverty.

This also teaches your child the importance of helping those who are less fortunate.

Conclusion

It is important to live simply, but it can often be difficult to instill those values in your children. Just follow these helpful tips, and your child should understand why it is so important. This will also teach them values that should endure when they become adults and have their own children.

1.

1.

In keeping with our blog theme of keeping things simple only 3 steps are required to enter:

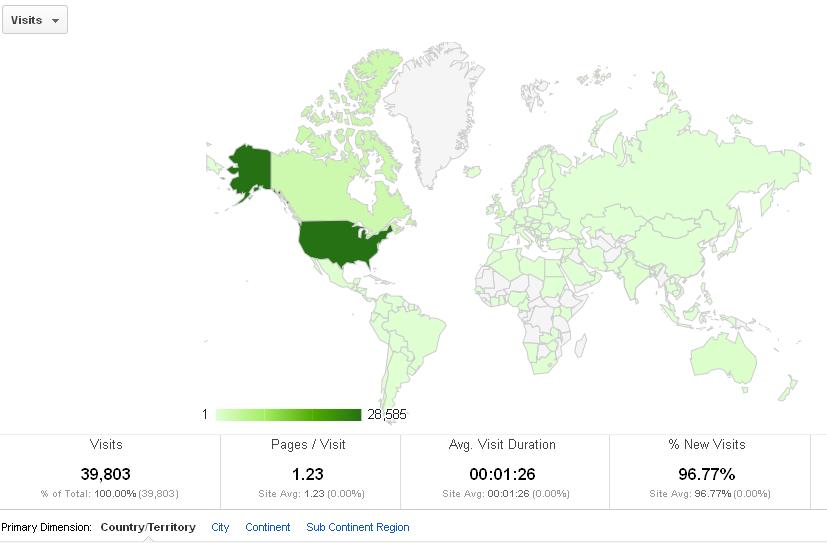

In keeping with our blog theme of keeping things simple only 3 steps are required to enter: The US Beaureau of Labor Statistics (BLS) has a massive

The US Beaureau of Labor Statistics (BLS) has a massive  The Most Important Skill to Master

The Most Important Skill to Master 1. Busking – Street Performance

1. Busking – Street Performance 4. Wedding Planner

4. Wedding Planner 8. Short Story Writer

8. Short Story Writer